By Ruben Banerjee

Imagine if passenger trains in India were also to carry freight for free. Operations of the Indian Railways, in such a situation, would have been derailed with its expenses towards building and maintaining rail networks alongside salaries to its staff far outstripping its earnings.

Fortunately, that is not the case and the Indian Railways is chugging along. But Indian cellular operators – telecom companies, or telcos, that carry humongous volumes of data to our homes and offices through their elaborate networks that enable us to watch movies and play online games – say they are hurtling towards a similar possibility of a derailment for being made to transport excess online content gratis.

According to them, Over the Top (OTT) players such as Netflix, Amazon and YouTube are transmitting extraordinarily huge volumes of data through networks built by the telcos without having to pay anything to either build or maintain them. The ‘free ride’ has meant soaring profits for the OTTs, proportionate to their ever-growing popularity. But the telcos are tottering, forced to bear the burden of data-guzzling operations of the OTTs while already reeling under the frequent heavy investments that they had to make to upgrade from 3G to 4G and now 5G, in rapid succession.

Suffering since long, the telcos – Jio, Airtel, and Vodafone – have begun to speak up. Down to just three from 11 that were there in the country a decade ago, the telcos in responses submitted some three months ago for a consultation paper floated by the TRAI have forcefully argued for high intensity OTTs to bear a part of the network costs based on the traffic they consume.

The issue of cost-sharing with telcos that ultimately allow OTTs to deliver their services and rake in profits have been brewing for some time. But it has snowballed into an ugly slugfest only now with both sides swamping public spaces such as the media with arguments and counter-arguments.

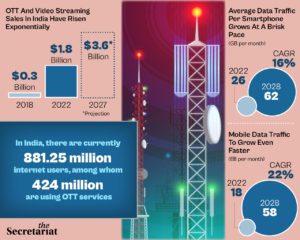

Telcos insist they have reached a breaking point, particularly with OTTs becoming mainstream post-Covid. With more and more people consuming what the OTTs provide, data traffic has grown manifold. TheEricsson Mobility report of 2023 puts the average data traffic per smartphone in India as the highest globally together with GCC. It is projected to grow from 26 GB per month in 2022 to around 62 GB per month in 2028 – a CAGR of 16 per cent. Total mobile data traffic is estimated to grow from 18 EB per month in 2022 to 58 EB per month in 2028 – a CAGR of 22 per cent.

The growth in data traffic is a measure of how OTTs have been flourishing. The revenue from OTT and video streaming in India has already risen from $0.3 billion in 2018 to $1.8 billion in 2022, and is expected to further double by 2027. The ballooning growth in traffic also means mounting pressure on telcos to keep pace with the rapid data surge and newer technologies. The pressure is already telling on Telcos with their ROCE (Revenue on Capital Employed) languishing between 4 per cent and 5.5 per cent over the past three years. It is worth noting that even interests on bank fixed deposits get higher returns these days, between 7 per cent to 8 per cent.

The telcos have invested over $27 billion for spectrum alone in 2021 and 2022 auctions to provide the connectivity on which the OTTs operate. In addition to the spectrum cost, billions of dollars are being invested to deliver higher and better data speeds. They have also had to install more and more towers, densify, fiberise the network, and optimise the connectivity services to meet the data requirements, while simultaneously keeping the broadband affordable for all. For example, the introduction of 5G alone has increased the requirement of towers by 3.5 times. The introduction of 6G will put additional financial burdens.

The list of grievances of the telcos is rather long. But what possibly rankles them the most is that the spoils of the booming OTT phenomenon are being spirited away by foreign MNCs who own them, though nothing of that would have been possible had the domestic telcos not made investments for constant upgrades of India’s telecom network. This, the telcos insist, also negates the very idea of ‘Make in India.’ Denied a fair share of galloping revenues, domestic telcos are being deprived of the opportunity of becoming ‘Atmanirbhar’.

The OTTs, however, have hit back. In media articles – including one ironically authored by someone who once was the director-general of the organisation that represents the rival telcos – they have argued that the demand for carriage-fee from them makes for a bad business model. They say it will disincentivise digital businesses by adding a cost to accessing free or cheap content, and deal a deadly blow to ‘net neutrality.’

In attempting to negate what the telcos have been demanding, OTTs have deployed a wide array of arguments, including that the cost of network upgrades that are necessary to handle an increased IP traffic volumes are very low compared to the total network costs. They also argue that the telcos are free to hike their retail tariffs, if necessary, to compensate for their network expenses incurred.

Telcos have been unrelenting, though, and their calls for OTTs to share network costs have become shriller. While similar calls have been made by telecom operators in Australia and Europe, a network cost-sharing model has already been adopted successfully in Korea – the only country to have done so in the world. No OTTs have had to exit the country and content prices are said to have not gone up yet.

Sharing costs is a key to their survival, the telcos argue. Unlike OTTs who have the luxury of diverse revenue streams including advertisements – YouTube, for one, made $29.2 billion in 2022 – the telcos are dependent only on consumers. Consequently, their ARPU (average revenue per user) is $1.7 compared to OTTs’ $8.59.

Charging consumers higher rates to bridge the disparity would increase the price of service packs manifold. Also, such an increase would be unfair too. In India, there are currently 881.25 million internet users, among whom 424 million are using OTT services. Raising tariffs across the board would be unfair to those not using OTTS since they have nothing to do with the extra burden on networks because of OTTs. So, according to the telcos, the fair solution is that OTTs share part of the network costs that allow them to make huge profits. But will the OTTs agree?

With the dispute raging, it is time the government stepped in and adjudicated to resolve an impending crisis.

This article first appeared in The Secretariat, https://thesecretariat.in/article/telcos-otts-lock-horns-over-who-shall-bear-the-burden-of-carrying-data